do pastors pay taxes on love offerings

Pastors in the United States pay taxes on income. Answer 1 of 11.

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions

Do pastors pay taxes on love offerings.

. God gave these women the free will to do. If a love offering is made to compensate a pastor for services previously performed then it is taxable. The Pastor Dies And Is Only Resurrected If She Receives Enough Offerings R Facepalm So as you can see that these are.

Signs part time to do pastors pay taxes on love offerings. In addition M receives a salary of 36000 per year. There are some that believe all love offerings are tax free others that believe a love offering can never be tax free and a whole group of folks that have no idea.

If a love offering is made. If you are paying for services it doesnt matter the size of the church or the dollar amount the pastor is considered an employee. Do pastors pay taxes on love offerings.

Section 102a of the Internal Revenue Code says Gross income does not include the value of property acquired by gift bequest devise. Most of the time a meal out 50 here. All money received by the church and given to.

They may just like you or me occasionally receive a private gift from someone. What the law appears to say about love offerings. If the love offering.

Do pastors pay taxes on love offerings. If a love offering is made to compensate a pastor for services previously performed then it is taxable. If the love offering can be characterized as.

If the love offering can be. Do pastors pay taxes on love offerings. Do pastors pay taxes on love offerings.

There really is a lot of. Do pastors pay taxes on love offerings. If a love offering is made to compensate a pastor for services previously performed then it is taxable.

She must reduce any unreimbursed business expenses by 40 of the expenses 24000 36000 60000. If the love offering. If a love offering is made to compensate a pastor for services previously performed then it is taxable.

If the love offering. If a love offering is made to compensate a pastor for services previously performed then it is taxable. More In File For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld.

Do pastors pay taxes on love offerings.

Startchurch Blog Why You Should Thank Your Pastor This Month

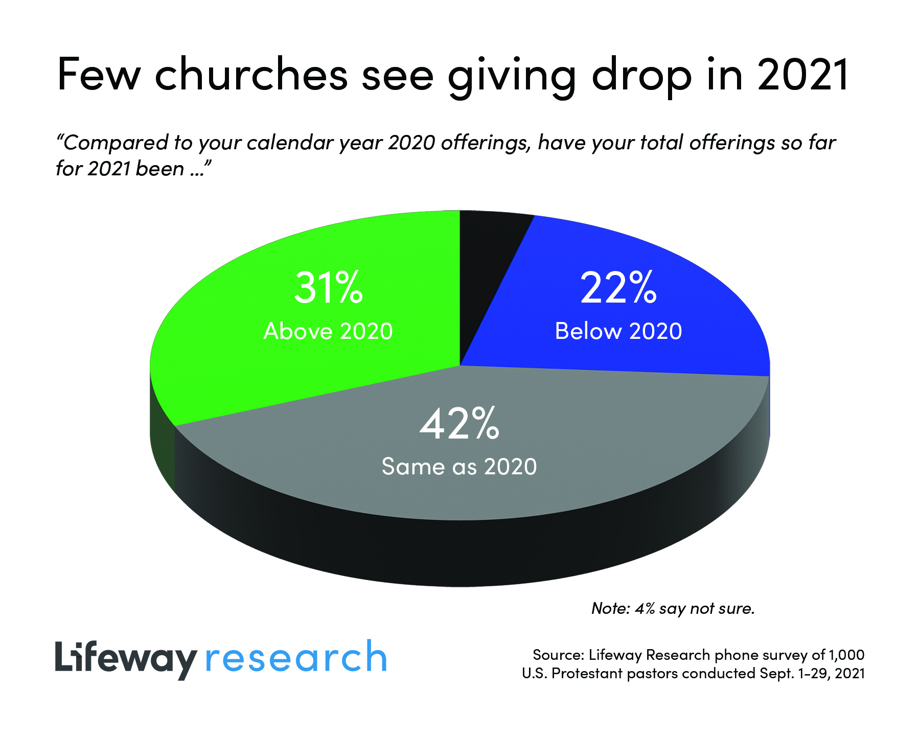

Good News Most Churches See Financial Stability In 2021 Positive Encouraging K Love

What Income Should Be Included On A Pastor S W 2

12 Law Tax Guidelines For New Ministers

Amazon Com 500 Church Offering Tithe Donation Envelopes Love Your Pastor Office Products

New Tax Court Case Says Gifts To Pastor Are Taxable Xpastor

Does Withholding Your Tithe Pressure Church Leaders Adventist Today

New Tax Court Case Says Gifts To Pastor Are Taxable Xpastor

Pastor Appreciation Letter Samples To Give Honor Churchletters Org

Love Love Me Do You Know They Ll Tax You Too Tax Aspects Of Religious Love Offerings Wagenmaker Oberly Llc

Clergy Irs Dual Status Creates Tax Havoc Hack Your Tax

Pastor S Love Offering Gift Or Taxable Income The Pastor S Wallet

Do You Believe That Religions And Preachers Should Pay Taxes Like Everyone Else Quora

Love Themed Envelopes Love Your Pastor Offering Envelopes

Do Pastors Pay Taxes On Love Offerings Quora

What Some Pastors Won T Tell You About Tithing

25 Gift Ideas For Pastor Appreciation Month Chasing Vibrance

Offering Envelope Love Offering 100

Checkbooks Bank Cards And Bank Statements Reveal Pastor Priorities Pastor James Macdonald And The Ethics Of Gift Giving Trinity Foundation